Bank reconciliation is the activity that compares the amounts contained in the bank statement with the data stored in the company. From this comparison, it is possible to reach the internal information and records of payment and receipts, as well as to correct errors and unforeseen information.

For bank reconciliation to be carried out most correctly and efficiently possible, it is necessary to follow some steps in the daily routine of the clinic, which directly implies activities aimed at the financial sector.

In the Ninsaúde Apolo software, it is possible to post the receipts and payments of the clinic through the Finance module, and with the Bank Reconciliation functionality, users can feed the system with financial data from bank statements provided by the bank through Internet Banking.

How to carry out an efficient bank reconciliation?

With bank reconciliation, it is possible to check whether the bank balance of the internal control, the entries, and their dates are identical to the bank statement. So that there are no errors, as mentioned above, it is necessary to create a routine within the clinic directed to these details involving the finances. For this, it is necessary to create the habit of:

1. Launch financial transactions daily

The clinic needs to monitor every financial entry and exit movement daily, informing all bank accounts involved. These movements do not only concern the receipt of consultations, or the payment of electricity, rent, and the internet, but also bank fees, taxes, payment of employees' salaries, etc.

All these receipts and payments, when correctly posted, also help in the formation of cash flow, an important tool that represents the movement of cash inflows and outflows in a given period in the company.

For this reason, it is essential to remember that home renovation, gifts for friends, and lunch with the family are just some examples of expenses that should never be added to the company's cash flow. Remember that, when mixing these types of expenses, the results shown in the cash flow will not bring information that matches the reality of the clinic. Besides, this action may confuse your goals, because in certain periods it may show a negative balance due to expenses that are not part of the company's daily routine.

2. Check the balance on the bank statement

A daily check must be made to find out if the initial and final balances of internal control match the balances in the bank statement.

At Ninsaúde Apolo the user must register the bank accounts that he will use so that he can make the receipt and payment entries, for this reason, within the system, there is also the possibility to generate an extract of the registered account accounts, which makes it possible to make such a comparison.

3. Use bank reconciliation to correct errors or post new securities

To use Ninsaúde Apolo's bank reconciliation is very simple, download it from your Internet Banking account an .OFX file (Open Financial Exchange) and upload it into the system. You must also inform which branch it is destined to (if your clinic has more than one service branch, otherwise just select Matrix/main) and inform which bank account.

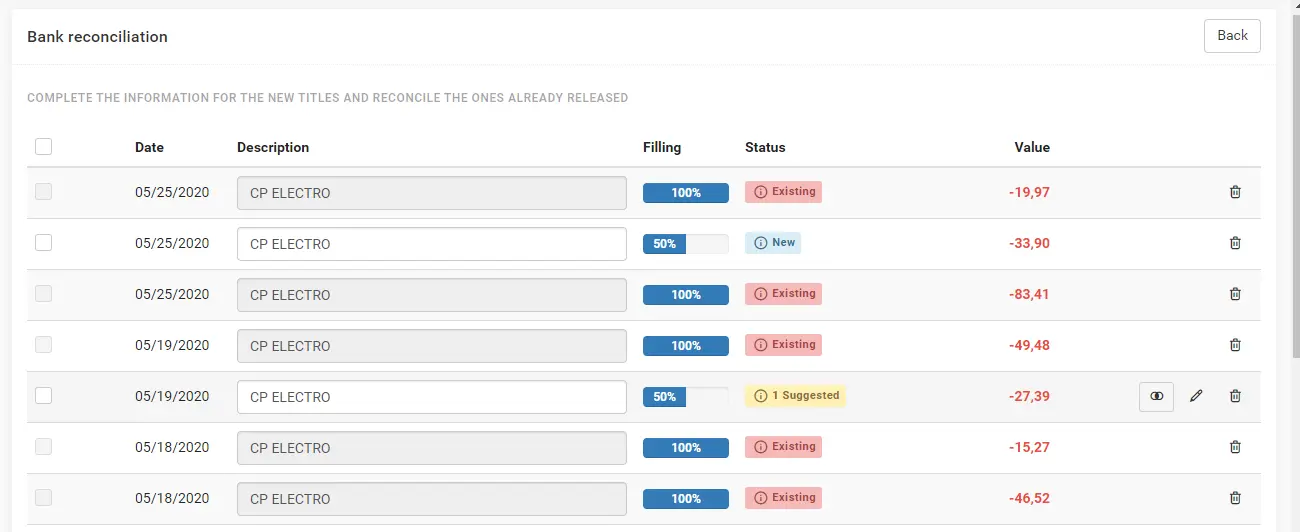

When importing the file, the system will also show some titles that have already been released on the system. The amount, launch date, and type (payment or receipt) will be taken into account so that the system can generate a status.

The "Existing" status, highlighted in red, suggests that that title already exists in the system. Titles that have a certain similarity will be highlighted in yellow with the status "Suggested". In this case, the user must make the conference so that there is no doubt that it is an existing title or not so that he can carry out the reconciliation. To do this, just press the "reconcile" icon.

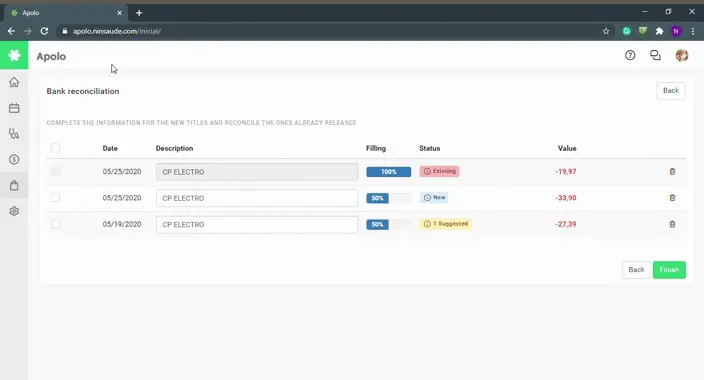

As shown in the example above, new titles in the system are also signaled by the color blue, showing the status "New". Also note that they have a percentage, which refers to the detail of that title. The process can be finalized, and the titles imported, only when they change all to 100%.

This is a very simple action, and to perform it just fill in the category, subcategory (optional), and type of payment fields. When finished, just press Finish.

At the conclusion of the transaction, all of the new titles will be posted to the system's financial system, with their respective changes (category, subcategory, type of payment, and document name).

Currently, even files from virtual banks, such as Nubank, can be imported into Apolo, which makes it even easier to check these financial data.

Did you like the tips but are not yet a Ninsaúde Apolo user? Get in touch and request a demo.