If you’re a clinic manager, physician-owner, or front-desk lead, you’ve probably asked this question: how much does a medical clinic need to earn to actually run smoothly? There isn’t a single magic number, because it depends on your care model, service mix, staffing, payer contracts, provider compensation, and—most importantly—how efficient your operations are.

The good news is you can set a realistic, measurable target using a simple framework: minimum revenue to break even + revenue to pay yourself well + revenue to grow with predictability. In this article, you’ll learn how to calculate your break-even point, profit margin, and scheduling-based targets—and which clinic performance metrics tell you whether your revenue is truly healthy.

What does “enough revenue” really mean for a clinic?

Revenue is the total money generated from visits, procedures, packages, imaging, follow-ups, and other services. But higher revenue doesn’t automatically mean higher profit. A clinic can be fully booked and still feel cash-tight because of denied claims, slow reimbursements, poor charge capture, high overhead, or messy provider payout rules.

When we talk about how much revenue a medical clinic needs, we’re really talking about three levels:

- Survival: covers fixed and variable costs without going negative.

- Financial health: leaves margin to reinvest, reduce risk, and pay owners and leadership consistently.

- Growth: funds hiring, expansion, marketing, technology, and patient experience improvements.

That’s why terms like break-even, P&L, cash flow, operating margin, and cost per visit matter more than a single monthly revenue goal.

Before we move on, one important note: if you manage a healthcare clinic and need better scheduling organization, a secure electronic health record, and centralized financial processes, Ninsaúde Clinic can streamline your daily operations. Get in touch to learn more.

Step 1: Calculate your clinic’s break-even point

Break-even is the minimum monthly revenue required to cover all costs—no profit, no loss. The simplest way to estimate it is to separate:

Fixed costs

Rent/lease, utilities baseline, payroll (W-2 staff), benefits, malpractice and business insurance, billing services, IT, software subscriptions, cleaning, licenses, basic marketing, accounting.

Variable costs

Card processing fees, medical supplies, lab/imaging pass-through costs, contractor/locum expenses, claims/billing fees tied to volume, marketing spend tied to acquisition, and provider compensation if it scales with volume.

A practical formula:

Break-even revenue = Fixed costs ÷ Contribution margin

And:

Contribution margin = 1 − (Variable costs ÷ Revenue)

If you don’t have perfect numbers yet, start with conservative estimates and refine monthly.

Step 2: Turn revenue into a profit target (not just a busy schedule)

Once you know break-even, you can choose a target operating margin. For many outpatient clinics, a healthy range can land somewhere around 10% to 25%, depending on specialty, payer mix (commercial vs Medicare/Medicaid), procedure mix, and overhead structure.

The goal isn’t a vanity number—it’s a margin that supports stability and growth:

- Heavier dependence on insurance reimbursement typically means tighter margins and a bigger need for operational efficiency.

- Higher share of cash-pay services or procedures can create more margin—if your workflows and pricing are disciplined.

- If you plan to hire, add rooms, open a second location, or invest in marketing, your profit target should fund that plan.

This is where high-intent search topics show up in real life: how to increase clinic revenue, medical practice profitability, clinic overhead percentage, healthcare cash flow management, and fee schedule pricing.

Step 3: Break the revenue goal into drivers you can control

Revenue is the outcome. To hit it, manage the engines behind it:

Average revenue per patient (ARPP) or per visit

How much each patient generates per visit or per episode of care. Increasing this isn’t about “upselling.” It’s about structuring follow-ups, care pathways, procedure planning, and reducing leakage.

Visit volume and schedule utilization

How many visits/procedures you perform—and what percentage of available slots are filled. This includes no-shows, late cancellations, and your ability to backfill openings.

Service mix

What portion comes from office visits vs procedures vs imaging vs packages vs ancillary services. Small shifts here can dramatically change margin.

Days in accounts receivable (A/R) and payer timing

Clinics can look “successful” on paper and still struggle because cash arrives weeks later. In the U.S., A/R discipline is non-negotiable.

A management platform like Ninsaúde Clinic helps here by connecting scheduling, financial tracking, operational routines, and reporting—so leadership can see what drives revenue and what quietly erodes profit without relying on scattered spreadsheets.

How much does a clinic need to make per day, per provider, and per exam room?

A highly effective way to make revenue targets actionable is to translate monthly goals into operational goals:

Daily revenue target

If your monthly target is X, divide by business days. This shifts the conversation from “we’re busy” to measurable performance.

Revenue target per provider

If you have multiple clinicians, calculate targets per schedule template, per session, or per clinic day. This reveals underperformance early and prevents one service line from subsidizing another without visibility.

Revenue target per room

If rooms are underutilized, your issue may not be marketing—it may be capacity management. Tracking room utilization can uncover quick wins.

This ties directly to what clinics search for: schedule optimization, reduce no-shows, increase patient throughput, and clinic capacity planning.

Revenue killers that look small—until they add up

No-shows and late cancellations

They create gaps that destroy predictability. Automated confirmations, reminders, and a clear cancellation policy reduce the impact.

Denied claims and rework

In the U.S., denials are one of the biggest silent profit drains. Common causes include eligibility issues, authorization gaps, coding errors, documentation problems, and missed filing deadlines. Clean workflows and repeatable checklists matter.

Provider compensation confusion

If payout rules aren’t clear (percentage, flat rate, per CPT, by payer, by location), you get disputes, errors, and end-of-month chaos.

Pricing without a method

Pricing too low can fill the schedule while starving the business. Pricing too high without clear value reduces demand. Strong pricing aligns cost, time, overhead, and positioning.

With Ninsaúde Clinic, clinics can build more control into day-to-day operations—especially around scheduling discipline, financial visibility, and performance reporting.

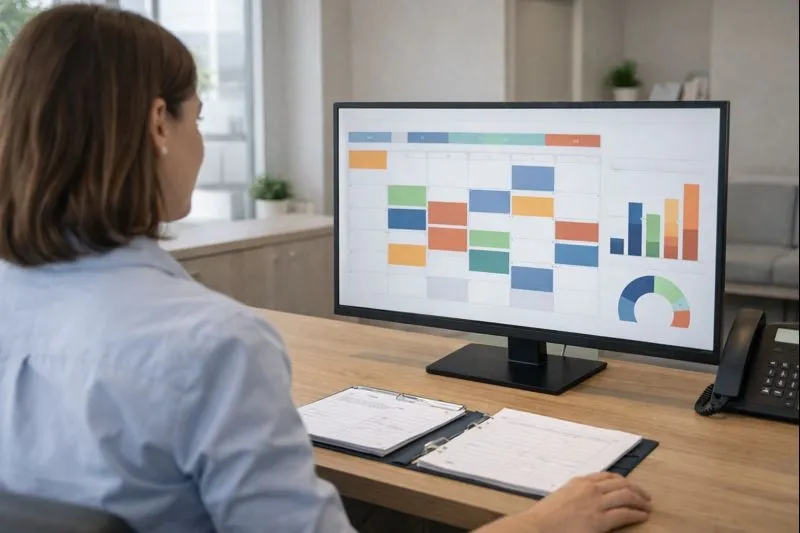

Metrics that show whether your revenue is actually healthy

If you want to know whether you’re on track, monitor these clinic KPIs:

- Monthly revenue (by location and service line)

- Operating margin and contribution margin

- Break-even point

- Schedule utilization rate

- No-show and cancellation rate

- Average revenue per visit/patient

- Days in A/R and aging buckets

- Denial rate and top denial reasons

- Cost per visit

- Cash flow (actual vs forecast)

- P&L by location

Consistency beats complexity: review weekly, make small adjustments, and avoid surprises at month-end.

How to increase revenue without relying only on “more demand”

More marketing can help—but many clinics unlock growth by fixing leakage:

- Reduce no-shows with automated reminders and confirmations

- Standardize follow-ups to increase predictability and continuity of care

- Build structured packages where clinically appropriate

- Lower denials through documentation and billing checklists

- Improve lead-to-appointment conversion with fast response and a clear intake process

- Elevate patient experience to drive retention and referrals

When a clinic runs on a system like Ninsaúde Clinic, leadership gains integrated visibility to spot bottlenecks: where schedules leak, where revenue slows down, where operations waste time, and which parts of the process cause avoidable losses.

A quick roadmap to set your revenue target

- List fixed and variable costs

- Estimate contribution margin

- Calculate break-even revenue

- Set your target operating margin

- Convert it into daily, provider, and room targets

- Track KPIs and optimize monthly

This moves your clinic from guesswork to data-driven management.

Key takeaways to apply now

- There’s no one-size number: the right revenue target depends on overhead, payer mix, service mix, and operational efficiency.

- Break-even is the foundation—without it, every target is just a guess.

- A healthy margin requires control of variable costs, especially denials, payment timing, and provider compensation.

- Targets work best when they become daily, provider-based, and room-based goals.

- KPIs like A/R days, denial rate, utilization, and cash flow reveal true financial health.

- Operational systems matter: Ninsaúde Clinic supports integrated management so decisions can be made with data—and losses don’t stay invisible.

Enjoyed these insights?

Keep following our blog for more content on clinic management, medical marketing, and healthcare innovation.

Are you a healthcare professional who hasn’t tried Ninsaúde Clinic yet? Discover how the platform can streamline processes and elevate the quality of patient care.