Organizing the financial sector of a clinic is not just about tracking income and expenses. It’s about ensuring the sustainability of the business, the peace of mind of healthcare professionals, and, above all, the quality of patient care. When finances are disorganized, the impact is felt everywhere—from team dissatisfaction to the interruption of essential investments.

In this article, we'll show you how to transform your clinic's financial management into a strategic tool. With well-defined processes, technology, and an analytical view of data, it’s possible to grow sustainably, make safe decisions, and stand out in the market.

Before we continue, we need to ask: Are you already familiar with Ninsaúde Clinic? Ninsaúde Clinic is a medical software with an agile and complete schedule, electronic medical records with legal validity, teleconsultation, financial control and much more. Schedule a demonstration or try Ninsaúde Clinic right now!

The Role of Finance in the Clinic's Health

Financial management goes beyond simply paying bills. It ensures the clinic has the resources to operate today, invest in the future, and maintain its credibility with suppliers, staff, and patients. Ignoring this sector is like driving in the dark.

Healthcare professionals often overlook finances due to lack of time or familiarity. However, a clinic is a business and needs a solid foundation to grow. Taking control is the first step toward transforming outcomes.

Separation Between Personal and Clinic Accounts

Mixing personal and clinic finances compromises visibility into business performance. It distorts profit calculation, complicates expense tracking, and affects important strategic decisions.

To avoid this, it’s ideal to keep separate accounts and define a set salary for the partners. This organization brings clarity and shows that the clinic operates with a professional and growth-ready mindset.

Daily Cash Flow Control

Monitoring cash flow daily helps the clinic know exactly how much is available, which payments are due, and which revenues are expected. This practice prevents financial surprises and makes management more secure.

With this control, the manager can respond quickly to unexpected events, adjust expenses, and even spot revenue and expense patterns. Tools like Ninsaúde Clinic automate this process, making daily management easier and more efficient.

Forecasting Revenue and Expenses

Planning revenues and expenses based on history and goals allows the clinic to anticipate scenarios and avoid unpleasant surprises. It's not enough to focus only on the current balance—it’s crucial to look ahead and understand how money will flow in the coming days, weeks, and months.

With reliable forecasts, the manager knows the best time to invest, when to cut costs, and which times of year demand more attention. This approach makes management more strategic and less reactive.

Defining Financial Goals

Clear goals serve as a roadmap for the team, helping everyone understand where the clinic is heading. When goals are realistic, measurable, and aligned with the business’s broader objectives, they encourage focus and productivity.

Setting goals like increasing revenue, reducing delinquency, or improving profit margins allows for more precise tracking of results. This makes it easier to identify what’s working and what needs adjustment along the way.

Monitoring Financial KPIs

Financial KPIs such as profitability, average ticket, cost per patient, and operational margin are essential for evaluating the clinic’s true performance. These indicators reveal where gains are, where there’s waste, and which areas need attention.

Regularly monitoring this data enables more strategic, less speculative decisions. With Ninsaúde Clinic, managers have access to complete dashboards that make financial analysis much more efficient.

Commission and Medical Payout Control

In clinics with multiple professionals, how commissions are calculated and paid directly affects the work environment. When the process is transparent, fair, and automated, it prevents conflicts, delays, and rework.

A good management system allows rules to be set by specialty, percentage, or period. This brings transparency, reduces errors, and ensures security for everyone involved.

Managing Delinquency

Delinquent patients compromise cash flow and can destabilize clinic finances. To avoid this, it’s important to have a clear collection process, with automatic reminders, negotiation options, and consistent recovery actions.

With Ninsaúde Pay, you can automate notifications and track all debts through organized reports. This makes the team’s job easier and delinquency management more efficient and professional.

Payment Method Integration

Offering options like Pix, credit and debit cards improves the patient experience and reduces payment friction. The easier the process, the higher the chances of receiving on time and avoiding delays.

With Ninsaúde Pay, the clinic can receive advance payments, organize payouts, and automatically record all transactions in the financial system. This brings agility, control, and more predictability to cash flow.

Analysis by Unit, Specialty, and Professional

When a clinic has multiple units or specialties, analyzing everything together can mask problems or disguise positive results. Breaking down data by location or area helps pinpoint bottlenecks and identify growth opportunities.

Segmented reports by unit or professional lead to more accurate decisions. With this information, you can invest better, correct flaws, and plan expansion more safely.

Managing Insurance Contracts and Health Plans

Accepting insurance increases patient volume but requires extra attention. Contracts, deadlines, values, and denials must be closely monitored to avoid losses and delays.

With integrated management, controlling TISS forms becomes safer and more efficient. Values can be automatically validated and compared to expected revenue to ensure everything is in order.

Tax Planning and Legal Compliance

Poorly planned taxation can directly affect clinic profitability. Choosing the wrong tax regime or missing out on legal incentives results in unnecessary taxes. That’s why it's essential to rely on a trusted accountant and review these decisions frequently.

Staying up to date with obligations also avoids fines and operational blocks. The financial sector is more than numbers—it ensures that the clinic operates safely and within legal requirements.

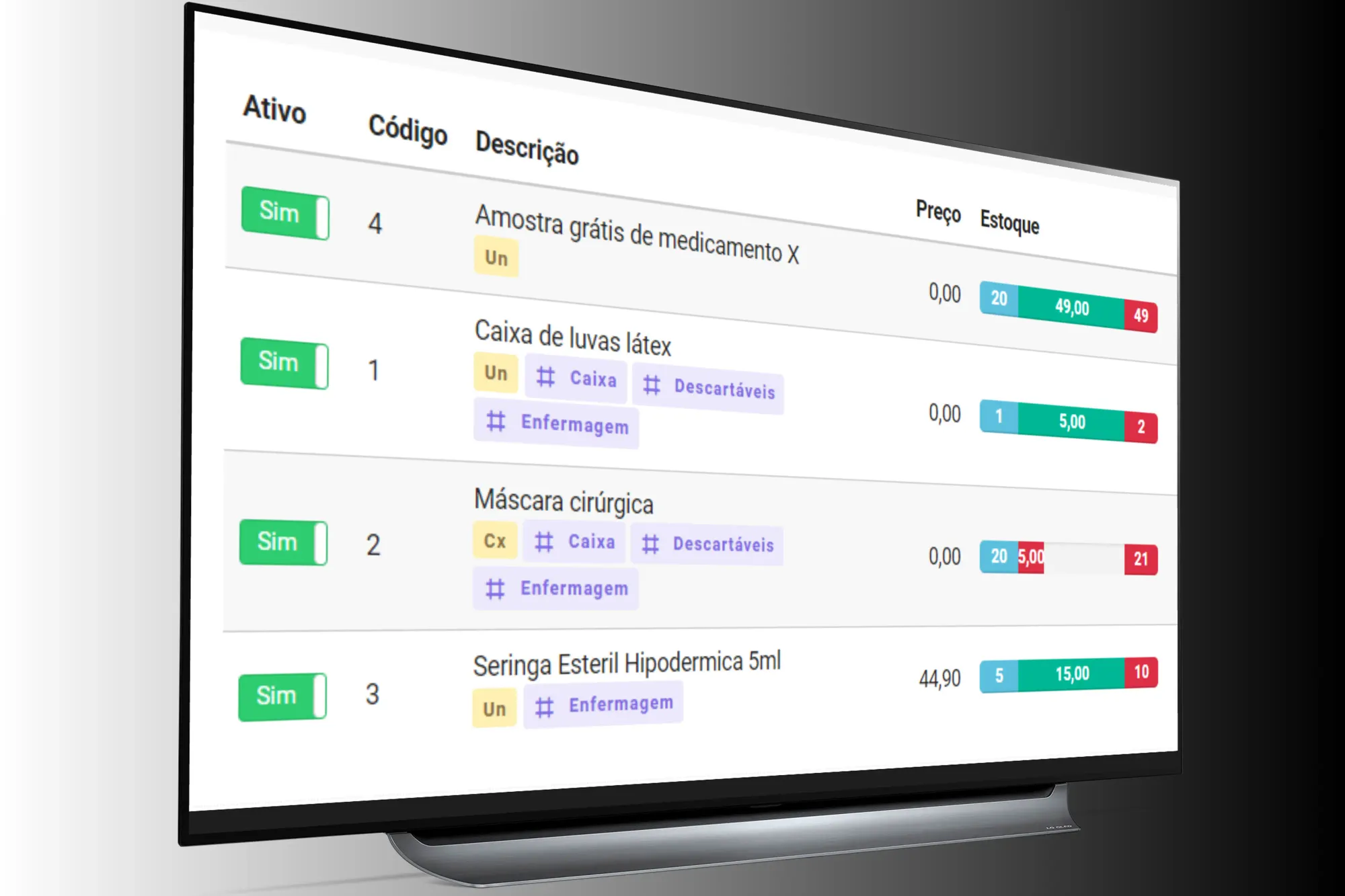

Inventory Management Integrated with Finance

Medications and supplies represent significant operational costs, especially in specialties like dermatology, gynecology, and dentistry. Without efficient control, it’s common to see waste or lack of critical items during care.

By integrating inventory with finance, the clinic gains clarity on the real cost of each procedure. This helps prevent losses, adjust pricing more precisely, and make data-driven decisions on consumption and restocking.

Periodic Review of Contracts and Fixed Costs

Fixed costs such as rent, internet, cleaning, and banking services may seem non-negotiable, but they deserve regular reviews. Evaluating these expenses often can uncover opportunities for renegotiation or switching to better suppliers.

This proactive approach prevents waste and helps maintain lean financial operations. As a result, resources are better allocated to what truly impacts the bottom line: patient care quality and experience.

Data-Based Investment Decisions

Every clinic wants to grow, but expanding without planning can cause more harm than good. Before opening new units, hiring staff, or expanding services, it’s essential to analyze numbers, understand the current scenario, and forecast the impact of decisions.

Strategic financial management clearly shows when to invest, how much it will cost, and what return to expect. That way, growth is structured and doesn’t jeopardize the clinic’s financial health.

Using Dashboards for Fast Decision-Making

Access to real-time visual dashboards makes management easier and improves decision-making quality. When indicators are visible and up to date, the response time to any change or issue is much faster.

With Ninsaúde Clinic, the clinic has access to custom dashboards with essential information like appointments, team productivity, and revenue. Everything is centralized, making management faster, easier, and more strategic.

Building a Financially Healthy Future

Organizing your clinic’s finances is an ongoing but highly rewarding task. With structured processes, support technology, and strategic vision, you can leave improvisation behind and build a solid, profitable, and growth-ready business.

By implementing these practices, the clinic gains more than control—it gains peace of mind, credibility, and the freedom to focus on what truly matters: delivering excellent care to patients.

Liked the information? Then prepare for a continuous journey of knowledge by following our blog. Are you a health professional and not yet familiar with the benefits of Ninsaúde Clinic? Stay ahead, optimize your processes, and elevate excellence in patient care!